- cross-posted to:

- china@sopuli.xyz

Cross-posted from: https://beehaw.org/post/11486860

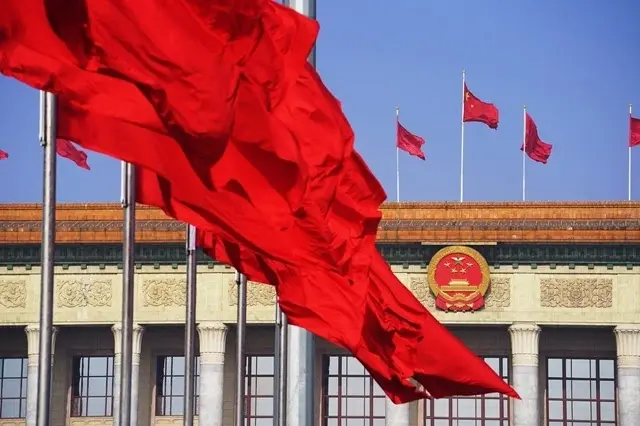

A huge problem with China’s economic model over the past two decades has been the fact that it has been a debt-based finance model massively concentrated on real estate speculation beyond what the economy can digest.

The problem is that real estate, especially apartments in China, for more than two decades, appeared to be a guaranteed money maker for owners as well as builders and banks and above all, local government officials. Prices rose annually in the double digits, sometimes by 20%. Millions of middle-class Chinese bought not just one, but two or more apartments, using the second as investment for future retirement.

China’s land is owned by the Communist Party, at the local level. It is leased long-term to construction firms who then borrow to build. For CP local government officials, revenue from local real estate land leasing and their infrastructure projects is their major revenue source.

If you could just throw that global crisis on the designated pile over there, that’d be great.

- Moira_Mayhem ( @Moira_Mayhem@beehaw.org ) 4•1 year ago

Most of it is the same crisis: unregulated capitalism.

I think I read this 5 years ago

I’m sure the US isn’t far behind. Our own real estate markets have been fucked for decades. Housing costs have more than tripled and wages have stagnated.

Good article with more insights than any other Western newspaper could give. Thx for sharing.