DJ Grothe on Facebook writes:

The Economist just did a big cover article on how great the U.S. economy is. Here is an unpaywalled version.

Real GDP is +8% vs. 2019, making “America…the only big economy that is back to its pre-pandemic growth trend.” This is compared to just 3% for Europe, 1% for Japan, and 0% for Britain.

Economists across the political spectrum (excepting the goofy ideological ones that feature on Fox News a lot) give most of the credit to the three big laws passed by Biden: the huge Infrastructure bill (that Trump always promised but never delivered), the Inflation Reduction Act, and the CHIPs Act, which provide incentives to build stuff in the U.S. And of course they credit Biden’s American Rescue Plan, too.

Good policy matters. Time for some skeptical debunking of the economic doomerism.

Biden is getting more done for the people than any president since FDR:

A smaller percentage of Americans are uninsured now than ever in our history.

Child poverty is at historic lows, thanks to Biden’s child tax credit in his American Rescue Plan.

Real wages are outpacing inflation for all socioeconomic quintiles.

The cost of living is actually going down (don’t believe the doomers)

America is energy independent for the first time in 40 years, and has been a net exporter of oil every year since 2020.

The cost of a gallon of gasoline nationwide on average is around three dollars a gallon, which is just a little higher than it was under Trump, and actually lower than it was under George W Bush and Obama.

Natural gas prices are at 10-year lows.

Wealth inequality under Biden is narrowing for the first time in almost 20 years…

The wealth of the lower two socioeconomic quintiles have seen their average household wealth increase by over 50% just since 2019.

The stock market is on an historic bull run.

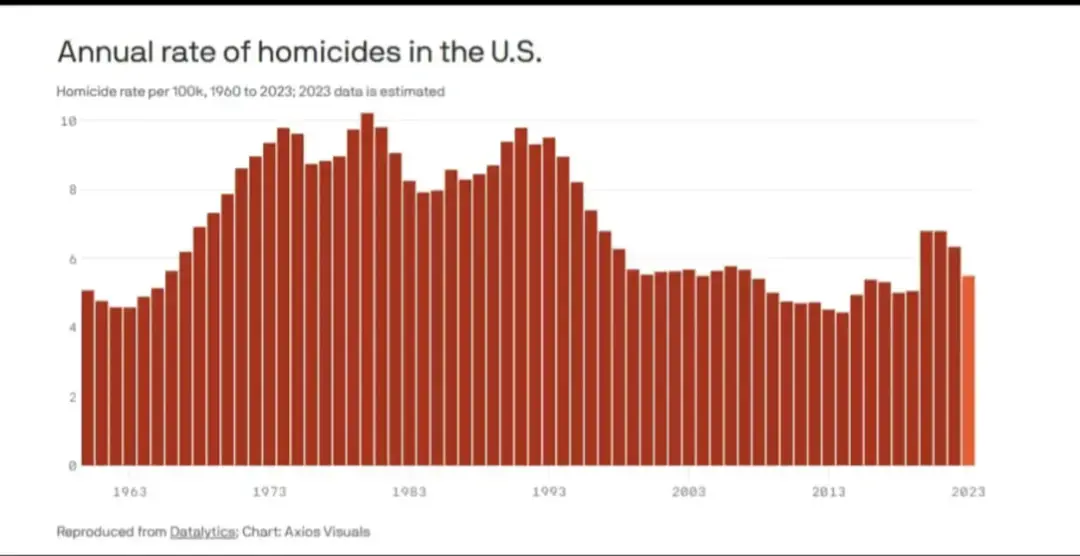

Violent crime, including the murder rate, is lower than it’s been in nearly 50 years.

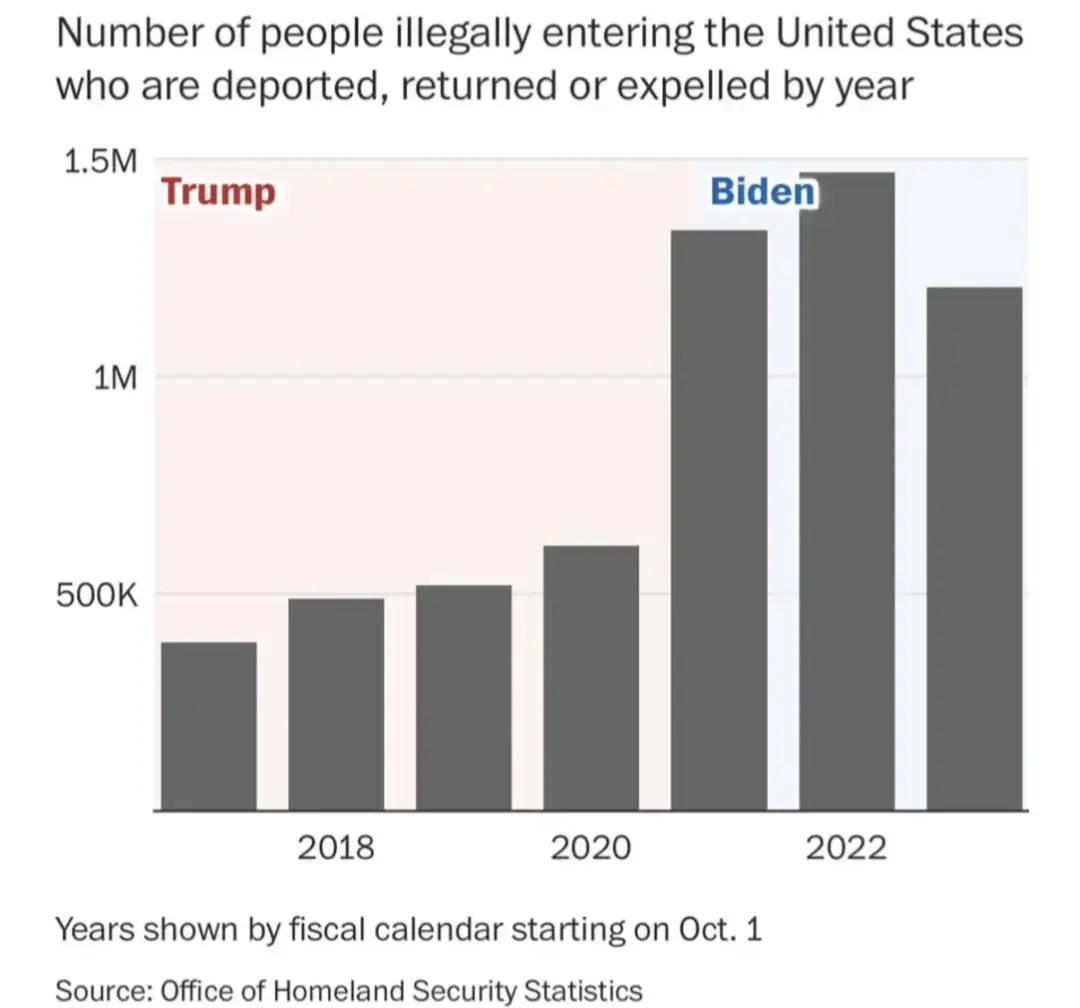

There is actually less illegal immigration under Biden than under Trump, believe it or not. (There are many more illegal border crossings now than under Trump, sadly, but there’s an order of magnitude more detentions and deportations under Biden than there were under Trump, which actually results in less illegal immigration now than under Trump.

Unemployment is at almost a 50-year low, and it’s never been lower than it is right now for Black Americans and Latinos.

Average debt-to-income ratios for American families are falling, and bankruptcies are at historic lows.

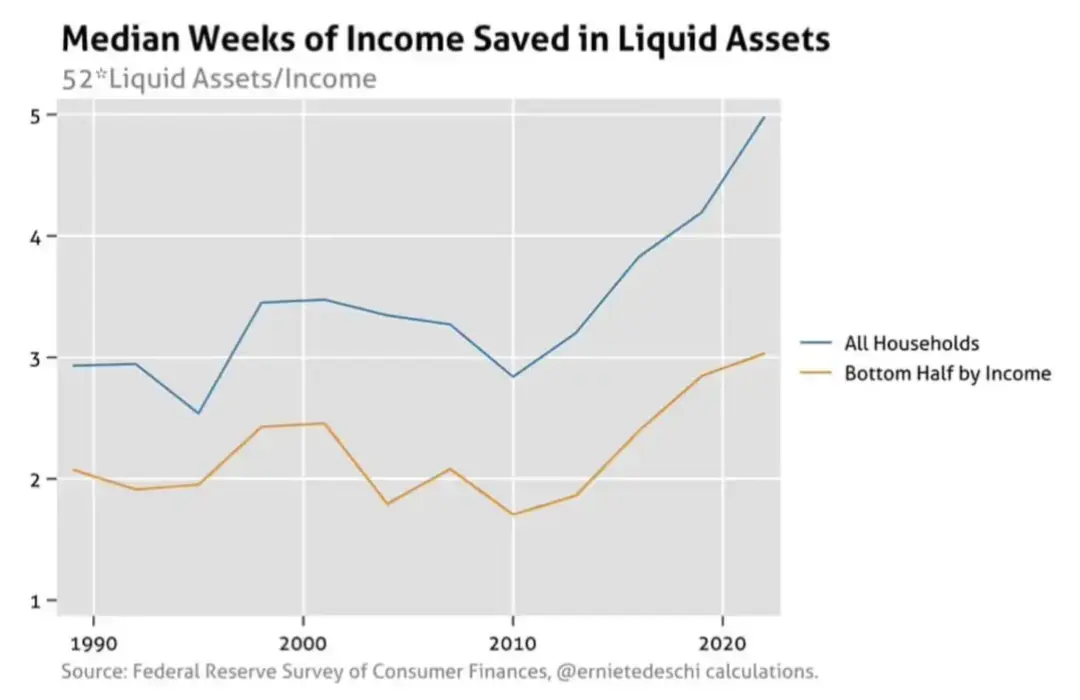

The average American household has cash savings equal to five weeks of income, which is the highest ever on record, and it’s also the record highest for the bottom half of the population by income.

Homicide rates have decreased since Trump.

Things certainly aren’t perfect, but they are much better for all socioeconomic quintiles than they were in 2019, and much better by many measures than they’ve been in many many decades.

Thanks Biden!

The problem is, this is not going to the working class. The rich are comfortable again and the poor are still poor. We can do better.

Economist article says: “Average weekly earnings for the country’s workers reached nearly $1,170 in October, up by around 3% in real terms since the end of 2019.”

I dunno what workers means here.

Wonder why they use average instead of median, which would be more meaningful. You can make the average go up just by raising the wages of the top 1% workers.

Wonder why they use average instead of mean

I think you may mean median, not mean, if you see what I mean.

Average could be either mean or median or mode or some other esoteric measure

Yep, you’re right, I meant median.

Theoretically yes, but that’s not what happened. Also not sure if average in op’s case is referring to mean or median, the word average could refer to either. But mean and median are close in this case. Median wage growth statistics are readily available, here’s median:

https://www.atlantafed.org/chcs/wage-growth-tracker

And if you dig into data more, you’ll find real wage growth (wage growth minus inflation) was strongest in the lowest income bracket, not the highest.

https://www.epi.org/publication/swa-wages-2022/

That’s not to say that just a couple years of higher wage growth in low income brackets will erase the US’s enormous long-standing problem with income inequality. And the top 10% have still been doing better than upper middle class with recent wage growth.

Most Americans have no clue what “median” means but do know what average means, sort of.

So you’re saying they know what the mean means!

It means rent went up around 3%.

Workers, in this case, means people that work for pay to live. See, payroll gets reported and as such the Gov. has numbers to back up their claims. You’ve got angry “what about me!” to back up yours.

We’ve seen the largest real wage growth among the lowest income workers since the 60s. Up until recently the real wage gain was actually entirely seen in essential, unionized, and low income workers, with the rich actually seeing real wage decreases in that time. Higher inflation is obviously going to be a lot bigger problem for owners than workers. It’s just the trend has a really long way to go to make for half a century of falling.

I’m happy to hear it. We can and should still do better; I’m hoping with a second term President Biden and the Democrats in congress can further improve things for us. Nothing will happen if we don’t protest, vote, and unionize though! We need to organize and keep applying pressure to our elected officials, relentlessly.

Wealth inequality is reduced for the first time in 20 years.

I’m a Biden voter, I will be voting for him in the general, but I want to hold him to a higher standard because he claims to be the working man’s president. Hopefully with a second term more can be accomplished.

Really seems like the growing problem is not the economy (as typically measured). The biggest problem for regular Americans is corporate greed.

All of these great measures of the economy, and people do not feel it, which means they are not getting their fair share.

Admittedly I cannot find evidence for the statement by Grothe that the benefits are in each quintile. However…

It is possible that corporate marketing has successfully bred dissatisfaction so that people are not happy with what they have. “Everybody needs a thneed”.

People are made to think that having a bad day is a big issue because they expect to be happy every day. I like to call it Feelgood fascism, especially when it is peer pressure.

The oft-cited consumer-price index exaggerates how much inflation erodes wages because it fails to capture how people adjust spending patterns amid rapid price increases.

Ah yes, real wages are up because we ignored inflation.

That’s not what that sentence means.

People respond to prices by changing their purchase behavior. If prices go up for some things, people tend to buy less of those things, and if prices go down for some things, then people tend to buy more of those things.

Across the entire basket of stuff that people buy (measured by a weighted percentage of how people were spending their budgets the previous year), people tend to move away from the stuff that got more expensive and towards the stuff that got less expensive, so that the current household budget shifts less than the inflation measure does. It’s called the substitution effect, and the CPI intentionally pretends it doesn’t happen - so that the numbers can be more meaningful as a measure of price changes, at the cost of understating how households actually experience inflation.

Yes, I understand how people respond to increasing prices, but that sentence claims CPI is a flawed metric without saying what items are getting more expensive. For a lot of places in the US, groceries and housing are the things that are getting more expensive. It is hard to substitute those things. Unless I am missing something the article also doesn’t mention what it uses as a deflator.

The math behind what I’m saying means that the phenomenon naturally happens regardless of which items move up or down, and even if all items move up (so long as they move up at different rates).

Eggs in February 2024 are down about 29% for the year from February 2023, down from the very high January 2023 spike. Ground beef is up about 7.4% for the year. Chicken breast is down 6%.

So a typical household that does eat animal products would likely have shifted away from beef towards chicken in the past year, even as the index weights them the same as they did before, month to month. That’s the kind of thing that doesn’t get captured until the relative weights index is updated.

Right, I get that. My point is that, at least in my area, all groceries are still up and rents are not going down. Overall expenses are still up, so the CPI translates well. I’m not saying things are not getting better, but IMO the article is cherry picking the best results and it doesn’t reflect most people’s reality.

My point is that groceries aren’t up equally, and groceries don’t all cost the same. Someone on a subsistence diet of lentils and rice might not have much room to adjust their food spending in response to prices, but the broader shifts of beef to pork, pork to chicken, chicken to eggs, meat to beans, reduction in sodas/chips/candy, etc., give a typical household some room to maneuver.

Put another way, if you ask people whether their grocery purchasing behavior has been affected by rising prices, most people will say yes. That behavioral shift is how we respond to price increases, to try to blunt the effects of a price increase.

(Arguing against the point of my own post) if people are substituting to “inferior” products then that indicates hardship and the CPI correctly measures that.

It is like if people started showering only once a week because hot water is too expensive. We should still be counting how much it costs to shower every day, not fudging the measurements to accomodate coping strategies.

I agree with that, as a measure of price changes over time. I think the CPI correctly ignores substitution bias month to month, so that we can get a better picture of the price changes.

In terms of household effects, though, the substitution effect tends to slightly reduce the effect of high prices on household budgets, and that’s what I understood as the meaning of that particular sentence at the top of this comment chain.

And I don’t think of these particular examples of inferior or superior goods. The relative cost of chicken, pork, ground beef, certain cuts of steak, lamb, lobster, etc. is different from place to place, and not necessarily a reflection of consumer preference in all places.

I don’t know how many times I can say I understand what you are saying, but it is not the case in my area. Most groceries are up, at least in my city. Overall grocery bills are still very high, even accounting for buying cheaper alternatives. Combine that with ever climbing rent and it is not nearly as rosey as the article claims. Again, I am not saying things aren’t slowly coming down, just that it is not as good as the article claims.

I’m specifically saying that even if groceries (or rent) are up by a lot, the math of what I’m describing still works out. So when you say “this is not the case in my area,” you’re effectively saying that you’ve made zero changes in how you shop for groceries, in response to the price increases. I think that’s probably not true for you in particular, and almost certainly not true for people in your area. Most people respond to prices with changed behavior.

That was a great simple explanation, thank you. I’ve certainly made some adjustments, and was thinking about it yesterday while shopping. Paper supplies have gotten so very expensive that I’ve (finally) purchased cloth napkins to use both for napkins and for smaller kitchen clean up jobs. I’ll be using less paper, and more water for laundry. I’m estimating 1-2 loads worth of napkins per month. Pretty sure it will be both cheaper and more environmentally friendly than paper towels.

I mean I’m no fan of Trump, but come on, Trump’s presidency ended in the middle of the COVID-19 pandemic. Of course GDP was absolutely shot.

That is why the comparison is with 2019. It wasn’t a pandemic until 2020.

“ended in the middle of the COVID-19 pandemic” which Fat Joffrey utterly failed at handling resulting in millions of additional infections. Shitler then proceeded to loot the health care supply chain and intentionally prevented many small businesses from getting PPP loans such that were devastated, as well as delaying and limiting aid to “the poors” that workers became behind in their rent by many months and lots of slightly better off workers lost their homes. But sure, do apply “nothing he could do” to it so you can “bOtH sIdEs” his, and entirely his, disastrous results.

I don’t deny that he utterly fucked up his response to the pandemic, but the real measure for that is lives lost, not GDP.

No, GDP took a huge hit as a direct result.

GDP went to hell in a hand basket across the world. I can’t think of a country that didn’t take a massive GDP hit.

And most of those were the result of not having any prevention. Entirely the fault of the guy that threw away the plan and fired the People that had been preparing to deal with it. The idiot gets no pass no matter how hard you hold your breath.

And most of those were the result of not having any prevention.

Not true. The main preventative measure for most countries was stay at home orders for all except essential workers. Working from home wasn’t much of a thing back then, so most places were absolutely caught with their pants down. Stay at home orders were unprecedented and completely unplanned for, most managers considered them unthinkable.

This is NOT me saying those orders were anything except the right thing to do, but it did completely zero the productivity of entire industries.

Those orders saved lives. And that is the metric we should be using. But since those particular numbers aren’t really knowable, we can instead use number of dead instead.

Human life is more important than the economy, and I will always lambast Trump for his decision making during this critical time.

The US had virtually no one staying home. That is a myth. The spread was the result of failed 45 policy, period. When you quite carrying water for the failed response, perhaps you can be taken seriously on other points.

The sugar high economy he fostered was going to have issues, covid or not. We should’ve raised interest rates when times were excellent but we kept trucking along as if 2.5% home mortgage rates and such were going to be standard forever. Companies got spoiled on more than a decade of essentially “free money,” and now that things have an interest rate they can feel they are flipping the fuck out.

Also 2019 was pre-pandemic. The economic effects weren’t being felt at all yet.

honestly I don’t like the over pumped economy we had before that as he pushed back on interest rate increases. I pretty much liked the pace at the end of obama. satan! the stock market has been out of wack since post 2000 as price to earning ratios went out the window.

Even without COVID, Trump was about to cause a bunch of inflation.

You couldn’t be more right about that too. That trade war with China was damn early in his administration. Who comes into a leadership position and turns to the next greatest competitor and targets them with sanctions? He slapped that painted target on himself reaaallly early.

Not only does the comparison predate the covid pandemic, it also says nothing in particular about Trump. Some people think the economy would have done great under him, some don’t, and some think other things are more important than just the economy. Still, there is no comparison to Trump here, there is only something showing that we’ve done better under Biden than many countries have done with their economies and leaders.

Trump’s GDP growth was 4% in 2019. I seriously doubt it would’ve doubled in 2020 without COVID.

Not that GDP growth is the only thing that matters, it’s just the comparison being used here.

Your quotes do not come from the article you linked. Instead they seem to come from this one: https://www.economist.com/briefing/2024/03/14/americas-economy-has-escaped-a-hard-landing

(Unpaywalled): https://12ft.io/proxy?q=https://www.economist.com/briefing/2024/03/14/americas-economy-has-escaped-a-hard-landing

I don’t see any of these statistics in the cited article (and the title is not accurate to the article’s). But nice fluffing!

Fair call. I have now added inline links

Joe bonden makes economy grow 138000% and your peepee go 385% and Trump bad vote for genocide

Or vote Trump and get three genocides for the price of one!

He supports the one in Gaza, the one against Ukrainians, and wants to start one here.

wants to start one here.

I would say already started one here. There are a fuckton of anti-trans laws going on the books across the country

Just imagine being this ignorant.

Imagine being an apologist for genocide joe

In a forum for reasoned argumentation, yours is merely inflammatory with shitty grammar and no factual information. Blocking.

Thanks! I encourage any other genocide apologist to do the same

I loathe Biden. I think this is mostly throwing out statistics that don’t accurately reflect the living conditions people are experiencing, in order to puff him up. But I can at least have a normal discussion without whatever this is.

Genocidal apology deserves only “this” as an answer. If you would like to engage with them in serious discussion, thats up to you

Who is that up at 6%?

Doing better than trump is a low damn bar.

Nevertheless, voting Trump back in would take US backwards.

I do not think any but a slim minority on here seriously believes that Trump is preferable, but being better than trump does not make one immune to criticism and doesn’t entitle Biden to enthusiastic support from people who didn’t want him as the candidate in the first place and only settled on him in the primaries as a compromise.

If a second trump term is as bad as we fear, then the democratic establishment should probably work harder to speak to the concerns of disaffected voters. A failure to make real commitments to pursue significant policy changes is tantamount to voting for trump at this point.