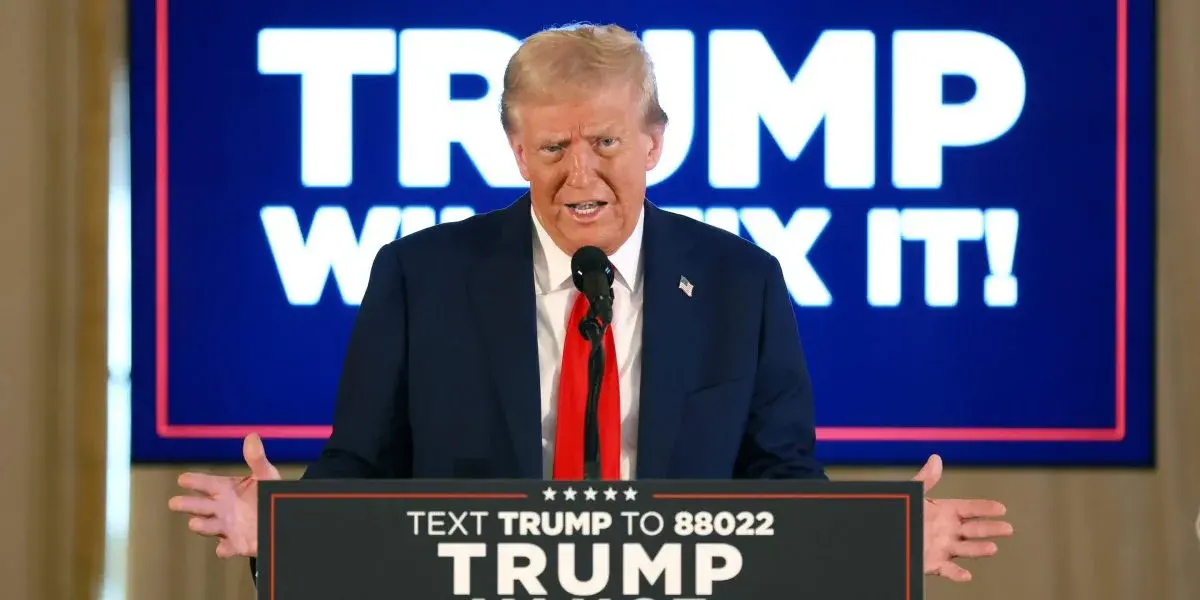

If former president and Republican nominee Donald Trump is elected next week, economists are betting that inflation will go up. Research firm Capital Economics plans to actually raise its interest-rate forecast in such a scenario because its economist Thomas Ryan suspects the Federal Reserve’s reaction will be to pull back on slashing rates.

[…]

We’re a little less than a week away from the presidential election, and the housing world is still at a standstill. The two candidates have plans, or concepts of plans, for housing. But inflation plays a key role: It can push prices higher even while real estate serves as a hedge against it. The Consumer Price Index rose just 2.4% in September from a year earlier, and that’s very close to the Fed’s target. Not to mention, the central bank entered into a cutting cycle that same month, slashing its key interest rate by 50 basis points. So you might think the worst is behind us, but it might not be.

In June, 16 Nobel Prize–winning economists signed a letter expressing their concern that Trump’s proposals could reignite inflation. Earlier this month, 68% of economists surveyed […] said inflation would likely be higher under a Trump presidency. On the other hand, 12% said the same for a Kamala Harris presidency.

[…]

That isn’t to say everything would be perfect if Harris were president—it won’t be, and housing will still be pretty stuck; maybe there’ll be a small recovery. Mortgage rates might come down a bit too. However, the expectation of another Trump presidency is already taking effect, and may only worsen if he is elected.

[…]