Having had my Visa Debit card blocked twice in as many weeks, I’m beginning to question if our current “Plastic” cards are fit for purpose. A somewhat long story follows with a question at the end:

About 2 weeks ago, Skinny decided not to honour my perfectly valid Visa card. I contacted my bank to find out why my card was being rejected. They let me know that some businesses won’t take payment on cards that are approaching expiry and Skinny, apparently, won’t take payment if the card expires in the following month. The card was due to expire in 8 weeks!

I find it ridiculous to reject payments that far from expiry! What would you do if you only had access to one credit card?

I switched cards on the account and in the process the Skinny interface initiated three transactions in quick succession, of which two should not have occurred. Another long story, but it took four hours (yes 4) to sort that out. These transactions triggered my bank to block the newly registered card and warned me via text message. Thankfully, a quick reply text was all that was needed to unblock the card.

My new card arrived a week or two later (they sent it out early) - all good once I used it to make a local purchase via EFTPOS. (This card had the same card number but different CVV)

A little over a week later, I receive a text message from my bank:

We’ve blocked your Visa Debit Card due to some suspicious transactions to Google YouTube Super. If this was you, please reply AUTHORISED. If not, please give us a call on #### or pop into your local branch

These were not my transactions, so a call was made. Apparently, the card number was/had been used on multiple (21) relatively small transactions in Australia. The bank’s only option was to cancel the card and re-issue me a new one. How these transactions were being validated without the CVV (unless they had ‘cracked’ it), I don’t know. These were Google transactions, so I would expect them to have been validated?

Luckily, I was due to travel to town - a little over two hours round trip! So I went into my closest branch and received a new card (with a new card number this time). Another EFTPOS transaction at a local shop and it’s good to go again.

I’ve no doubt there are others who have had similar experiences?

I can’t remember the last time I used cash, though I always carry some. For me, a cashless society mostly works.

The discussion I had with my bank suggests that these type of blocks, due to unauthorised transactions, are on the rise significantly.

So what is the future of “money”? How can transactions be made without inconvenience, but still be secure and safe from unauthorised access?

Really just a topic starter and I felt I needed to tell the story.

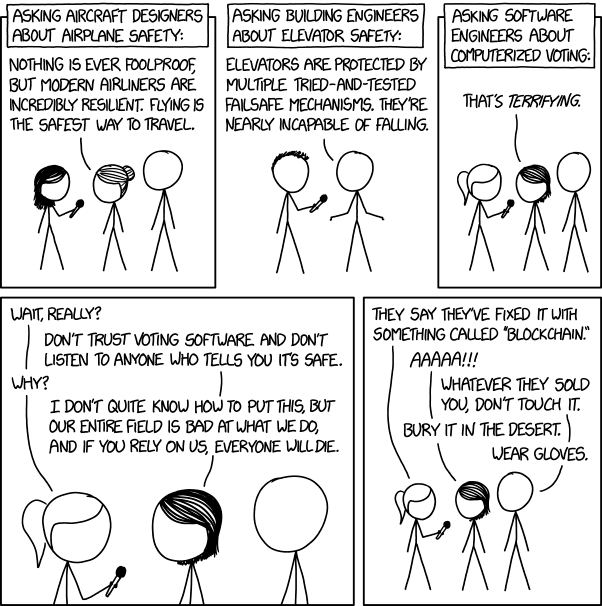

🛠️ memes aside, I’m a software developer and I don’t trust software-only systems with no fallback. Too many moving parts that can go wrong.

100% this

I live in germany and never leave the house without cash because at least once a month, one of those stupid card terminals will either refuse to work properly or be blocked by my bank for no reason.

Those cards are a terrible implementation of digital money and I hope they die a swift death to make way for something that actually works.

Until then, cash it is.

- ∟⊔⊤∦∣≶ ( @luthis@lemmy.nz ) English5•11 months ago

I have never had the problems you describe.

I think for the Skinny related issue, that’s their fuckup, not the bank’s.

Cashless society, very bad idea. It wouldn’t function and I think the top level knows that.

I don’t see any change to using cash, every store and most places except public transport accept cash.

We will continue to see developments on the digital side, ie wristbands and chips for contactless payment.

Perhaps in another generation when we have had cashless for so long it becomes less common, but so much of the lower class depends on physical cash, that unless the banks issue physical devices to stand in for cellphones and mark-of-the-beast implanted chips, cash will remain.

I don’t know any parent who doesn’t want cash to remain a thing. They need to be able to give their kid cash to go buy lollies at the dairy, or for their tooth etc.

I think that this was just a shit situation caused by skinny and that digital and cash will continue to function without major issue.

- Juno ( @Juno@beehaw.org ) English2•11 months ago

I only read all this because it happened to me recently when I got gas out of state. It happens to people. People get diseases when you don’t either. Telling them you’re healthy won’t help.

Amen brother 🙏

15 years ago or so, I worked for a bank that made their cards not work at Walmart due to the high rate of fraud there.

When a customer called it, the solution was to tell them this and ask them to use a different card or an atm for cash.

If they only had one card, they were out of luck.

I can’t remember, but they might have been able run the card as debit and use their pin.

Either way, cashless is not a good society.

Monero, it’s the only digital currency that resembles cash.

Cryptocurrency, in all its flavours and colours, is a scam. Don’t buy into that bullshit.

This is a blanket statement that simply isn’t true.

Most crypto is a scam, for sure, but the technology is sound and could easily be implemented for everyday life.

- argv_minus_one ( @argv_minus_one@beehaw.org ) English2•11 months ago

Maybe it theoretically could, but it won’t, because it’s a scam and its entire purpose is to be a scam. That’s why cryptocurrency was invented: to separate people from their actual money.

It most definitely was not invented to “separate people from their actual money”, and since the original white paper’s author is unknown, you absolutely cannot back up that statement.

Many crypto currencies have been made more accurately as pyramid schemes, definitely. But nothing about the technology requires this, Bitcoin and many of the largest, most stable currencies absolutely weren’t invented as pyramid schemes, and there is nothing stopping a government from using the technology to created a fiat currency.

Not useful to make everyday purchases is it?

I went through a round of this with my bank a couple of years ago. They would reissue a card that would be compromised in days and the cycle would go around. It was an internal security problem for them that eventually got sorted out. I remember one card was cloned and bought several dozen monthly transit passes in Boston (contactless purchase) before it was caught. I live in Western Canada. So yes I carry cash. A lot of younger retailers don’t even accept it. They just have that square tap system tied to their phones.

2FA would probably be part of the answer: whereby you get a text / app notification with a unique code to confirm a transaction. Not always convenient, I pretty much always sigh when having to use them, but at least significantly harder for people to spoof.

I can imagine a future, not that far off, where physical cards are obsolete, and phones are the primary identifying factor in everyday transactions.

But yeah that whole not honoring transactions from a near(ish) to expiry card thing is total BS. I’d be looking to ditch Skinny if that happened to me.

I think Two-Factor Authentication is already part of the solution i.e. there are some transactions I do now that require a code sent by text as part of the transaction, but it can’t be the full solution yet. Why, because there are still plenty of people who don’t have mobile phones (many in other parts of the world). In its current form it’s certainly not convenient for day to day purchases etc.

Skinny is good value, not considering leaving them, but the expiry thing is crap. I’ve not experienced it with anyone else (oh, their online chat system sucks too, especially if you get kicked off and have to start the process all over again).

I was with Robobank a while back and they had a little dongle (Digipass) that generated access/security codes, i.e. 2FA, on all transactions. It was f’ing awful to use and was the reason I left.

- argv_minus_one ( @argv_minus_one@beehaw.org ) English2•11 months ago

What was wrong with it?

I should confess that there were other reasons I left as well e.g. lowing interest rates, poor communications. Also note that with the account I had at the time, there were not “Plastic” cards that came with the account - this was an online only transaction account.

The Digipass dongle felt like it was designed for a child, very small with small buttons, which had very poor tacktile response, leading to lots of missed numbers and having to go back and re-enter. Having to dig it out every time you wanted to move money between accounts or out of accounts. Entering codes for EVERY transaction. Secure yes, convenient no.

There in lies the problem - the balance between security and convenience I guess?

- argv_minus_one ( @argv_minus_one@beehaw.org ) English2•11 months ago

I’ve envisioned a device that just displays the name of the merchant and the transaction amount, and all you have to do is push “yes” or “no”.

What you’re describing seems like a…not very good way to realize that vision.

I had to do a 2fa over a $5 transaction the other day, I was a bit annoyed.

But yeah that whole not honoring transactions from a near(ish) to expiry card thing is total BS. I’d be looking to ditch Skinny if that happened to me.

I’m trying to think through the logic of it. You’d think a card would be good up to expiry. Is it that banks send out new cards when expiry is approaching, people throw the old one in the bin, and people find them and use them in the short time before expiry?

If the bank can activate the replacement card when it’s first used locally, why can’t they inactivate the old card at the same time?

Normally these sorts of rules only exist because the company has had a problem in the past, but it does seem a bit odd to me.

If the bank can activate the replacement card when it’s first used locally, why can’t they inactivate the old card at the same time?

I was under the impression that’s exactly what they do?

Then why do skinny not accept cards up to expiry?

You have to give them the number all over again because the expiry date is different.

The OP’s problem is that Skinny wouldn’t accept a card that was close to expiry, even though they didn’t have a replacement card yet. I’m curious as to why that would be a policy.

People who get billed at month end but the card is no longer valid and they don’t update so there’s no way to get then to pay excerpt trying the collections route.

Or, just make try to ensure any card used will be billable at month end.

It’s a bit stupidly implimented, because of the way it fails to align with how banks do things. IMO it’d be better applied only to new accounts.

Ah I see, that does make sense if the card is being entered to cover a future transaction.

I’ve only ever done prepay my whole life so I didn’t think of post pay customers.

You are lucky the bank is catching these unauthorised transactions and not holding you responsible for them.

Cashless requires an effective cash substitute, otherwise people who can’t get bank accounts are not able to use money.

These people include but are not limited to:

- newly adult children of “off grid” or religious cult parents who did not register their birth, or whose parents are withholding their vital documents

- people who have lost all their identification in a disruptive life event such as a house fire, flight from a war zone, unexpected incarceration with subsequent loss of home and belongings, or due to activity resulting from untreated mental health conditions

- identity theft victims whose electronic reputation has been destroyed

- victims of bureaucratic error who are officially dead or otherwise tangled in red tape

- immigrants, migrants, and refugees who are not “legal” and who therefore can’t get the documentation they need (regardless what you think of those who skirt immigration laws, this group includes people brought into a country as children, and human trafficking victims and even if it didn’t the punishment for illegal immigration should be deportation, not starving on the streets)

Outside of that, while a cash or cash equivalent economy allows for various criminal and black market economy, it also provides a buffer for targeted minorities or other potential victims if there’s an outbreak of fascist and/or genocidal government.

This is the bulk of why I think we need some form of legal currency that is bearer only.

I see a lot of comments that a cashless society would not be a good one, but no reasons behind this.

Sure, current implementations and technology make it nonviable, but I cannot think of any reason why this could not change in the future.

Hypothetically, the government’s central bank could issue a crypto-based currency, backed by them, and equal exactly to the dollar. Let’s call it the Kiwicoin. This coin would work using an official wallet, and perhaps other 3rd party wallets. It could be used with a debit-card, like some places already have (crypto.com, wirex, etc). You could exchange fist into this, and back, 1:1 with no fees. Instant transactions, resilient network, complete record of transactions. There are many potential benefits.

This is only one option, I’m sure there are other ways of executing a cashless society. Cash has no intrinsic value, and other than being a physical object, has no benefit over the numbers in your bank, and several downsides.

I’m with you on this. None of the things people are worried about are inherently unsolvable, they just haven’t been solved yet.

Some shops are already cashless, and over time I expect this to grow. I don’t think the government will suddenly decide to stop making cash, but rather over the next few decades I think the number of shops not taking cash will increase until it becomes the majority. There will be a critical point where enough shops don’t take cash that people stop carrying cash, then the remaining shops taking cash will probably see a significant drop in the number of people using cash until no one bothers accepting it.

Also, I seem to recall a paper-based EFTPOS being used in the past when I’ve been to a supermarket when the EFTPOS network was down. It’s been a long time since I’ve seen a supermarket with EFTPOS down though.

One simple solution may be to revert back to the old way of doing things. Not cash, but those zip zap credit card machines that shops used to have.

I called them ‘shick shack’ machines. 😂

What are folks in places like Gisborne supposed to do when the infrastructure for digital payments goes out in another flood?