- cross-posted to:

- hackernews@lemmy.smeargle.fans

- technology@lemmy.zip

is this the ‘jumped the shark’ moment for companies? as soon as they go ‘public’ you can no longer assume their product is their priority.

Yes

You can expect them to drop at maybe one more good product, as going public is what companies do when they want to raise a lot of funds for some project

But after THAT, when it turns out that the new product is just… Making money instead of making ALL the money, the investors will take over and from then on it’s fucked.

But yeah RPi has alternatives now. No need to tie yourself to them when they DO sink.

I ordered a BananaPi board years ago but then life took me places where I didn’t have time or energy to follow up. I’ve recently rejoined the hobbyist homelab market, so I’ve quite interested. I’d read that drivers could be an issue with non-Pi boards but haven’t ever found out. Which boards / companies are recommendation-worthy at the moment?

Asking twice because two people had similar replies and I’m looking for feedback, not because I want to spam the thread.

The question is always: What do you want to use it for?

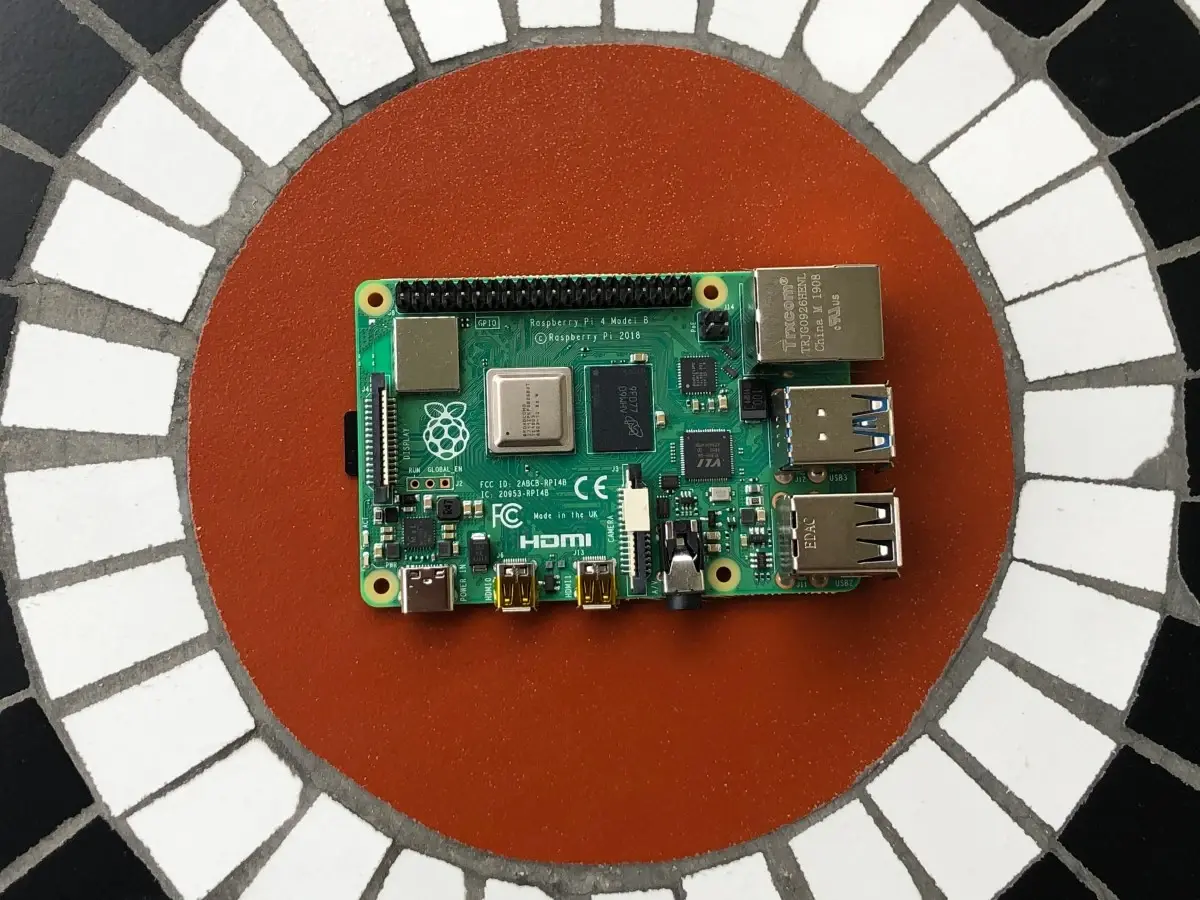

When raspberry started the landscape was very difficult. Small computer boards were expensive, now there’s the N100 if you need a tiny cheap computer. Microcontrollers were really dumb and unconnected, now there’s the ESP32 which has WiFi and Bluetooth and decent performance. Right in the middle of this wide spectrum is the raspberry pi and its clones.

This is a very different situation than in the introduction era where PCs were heavy and expensive and microcontrollers were dumb. There was a much wider niche for the raspberry then. For a small server I would now get a $100 N100 from aliexpress. For embedded electronics I would grab a $10 ESP32. Only in the middle is the raspberry pi, but the problem is, it’s only in the middle in terms of performance, not price. A raspberry pi with case, PSU, storage etc costs more than a decked out N100, while actually being slower.

The only remaining usecase I see for a pi 5 would be an electronics project where you need some more compute than a microcontroller can provide, like some machine vision project. Otherwise:

- Do you want to make some electronics IoT thingy: Get an ESP32

- Do you want a small light computer or server: Get an N100

Ad soon as they go public, their product is their share price. And even before then, since most growing private companies seek out private investment long before going public.

Exactly. I’m not worried though. There are so many alternatives these days.

Would be really nice to name them when posting such a comment…

Here’s one nice list which also reflects the status of their usefulness. Physical availability varies widely, though.

I ordered a BananaPi board years ago but then life took me places where I didn’t have time or energy to follow up. I’ve recently rejoined the hobbyist homelab market, so I’ve quite interested. I’d read that drivers could be an issue with non-Pi boards but haven’t ever found out. Which boards / companies are recommendation-worthy at the moment?

Asking twice because two people had similar replies and I’m looking for feedback, not because I want to spam the thread.

Legally the product is no longer their priority, maximising shareholder profits is their priority.

Not many companies manage to not get twisted to a worse product for the customers, though their ads get really good

really sounds like the stock market is just human greed distilled and removed from all direct responsibility.

i cant understand how anyone can defend it. it is a cancer

God damn it. It was nice while it lasted

INB4 trust fund babies and gormless capitalists go and ream every last fucking cent from the brand destroying it in the process before moving on to the next thing.

as is tradition

The enshittification begins.

How much stock ownership remains with the nonprofit Raspberry Pi Foundation? And will that be enough to hold off shareholder complaints that they aren’t being evil enough?

I assume OpenAI sort of demonstrates the fragility of that arrangement…

No, being a public company the CEO is legally obligated to chase profits

No, shareholder interest, which - in the absence of the clear desire of the majority shareholder(s) - is assumed to be profit. So I think the question above is quite important actually

That is a fair point

This is a common misconception based on an argument put forward my Milton Friedman. It’s based on legal cases where CEOs were taken to court for knowingly defrauding shareholders for their own personal gain (say, selling all of a companies assets of the company to a different company the ceo owns privately for a single dollar).

Friedman argued that these cases set precedent that meant all CEO were legally obligated to maximize shareholder value and could be held legally accountable for not doing so. Friedman was wrong about this, like many other things he said, as he was not a lawyer, nor a particularly good economist. No CEO has even been successfully sued for “failing to maximize shareholder value” despite some people taking Friedman’s work to heart and trying to do so.

It comes from the case against Henry Ford after he saw his company was making gobs of cash and decided to give some of that to his employees. Shareholders successfully sued him to stop this on the grounds that he has a fiduciary duty to shareholders.

https://en.m.wikipedia.org/wiki/Dodge_v._Ford_Motor_Co.

As with anything legal, there is nuance, but the basic assertion that there is fiduciary duty to shareholders is not wrong.

He was sued for miss use of company profits, not for failing to maximize profits.

He took profits and was reinvesting in new plants and cutting car prices, while also ending dividend payments to do so. That was the crux of the case, ending dividend payments despite having money to continue paying them. This case is routinely held up as an example of shareholder primacy but has been dismissed as an example of such by most modern thinkers In the field, in large part because the court also ruled that he had final say on how to proceed with company operation. Increasing worker pay was not the issue, ending dividends to make capital investment was.

Edit: also, I should clarify, he was the majority share holder, and the minority shareholders could thus not replace him with someone willing to pay dividends. He was not being sued for failing to seek profits, he was being sued for holding those profits hostage from other shareholders.

I guess it depends on what jurisdiction you’re in huh

The article said that they are the major shareholder.

I hope this isn’t the prelude to a decline. I just ordered my third Pi over the weekend. It should arrive today. I’d hate to see the platform squandered by “make number go up” types.

They’ve been declining for years. It’s time the community ditched them for RISC-V machines.

I’m not familiar. Any recommendations?

Super helpful, thank you! But maybe I missed one point: why is Arm bad or RiscV better? Why should we encourage Risc cpus?

RISC-V is an open instruction set, which should be what the Pi foundation (if their open source mission is to be taken at face value) would be switching to if they weren’t just a way for Broadcom to push their chips on the maker community under the guise of open source.

RISC-V, an open-source instruction set architecture (ISA), has been making waves in the world of computer architecture. “RISC-V” stands for Reduced Instruction Set Computing (RISC) and the “V” represents the fifth version of the RISC architecture. Unlike proprietary architectures such as ARM and x86, RISC-V is an open standard, allowing anyone to implement it without the need for licensing fees. This openness has led to a surge in interest and adoption across various industries, making RISC-V a key player in the evolving landscape of computing. At its core, an instruction set architecture defines the interface between software and hardware, dictating how a processor executes instructions. RISC-V follows the principles of RISC, emphasizing simplicity and efficiency in instruction execution. This simplicity facilitates easier chip design, reduces complexity, and allows for more straightforward optimization of hardware and software interactions. This stands in contrast to Complex Instruction Set Computing (CISC) architectures, which have more elaborate and versatile instructions, often resulting in more complex hardware designs. The open nature of RISC-V is one of its most significant strengths. The ISA is maintained by the RISC-V Foundation, a non-profit organization that oversees its development and evolution. The RISC-V Foundation owns, maintains, and publishes the RISC-V Instruction Set Architecture (ISA), an open standard for processor design. The RISC-V Foundation was founded in 2015 and comprises more than 200 members from various sectors of the industry and academia.

Hope that happens, maybe my riscv potato might get some use

Amen. I’d love to see Home Assistant start using it. I’m not holding out hope, though, because the guy behind Home Assistant is actively hostile.

I have a uconsole r01

I wanna be able to use it. Its borderline unuaaible rn

Much like the fediverse, we’re very early on that technology. We’re waiting for the network effect to take hold in both areas. Once it does, things will improve significantly, IMO.

For fucks sake.

I just wanted a cm4

:neocat_cry:

I’m surprised it lasted this long. It was always kinda just a marketing gimmick for broadcom that got out of hand.

Huh! I didn’t realize that. It was a cool product.

Shit