I mean you could even take the bottom number and leave them with the top number and they could still live in unimaginable luxury forever. Or just take the lot because fuck em lol.

I couldn’t imagine spending $1 billion in my entire life, let alone 3-4.

Most of their billions is ownership in companies they grew into what they are today. It’s not like they have billions to spend, it’s that their ownership is worth billions according to the market.

You all realize they don’t have that money laying around to pay the IRS right? They own companies, those companies are worth that much. To pay that you would have to liquidate those companies. So no more Amazon, Tesla, Space X, etc…

no more Amazon, Tesla, Space X, etc…

Oh no! Anyway, so how can we make this happen, like, yesterday?

I highly recommend you to read the paper billionare argument. The market can stand the liquidation of most of those companies without making them go bankrupt, we don’t want them to stop existing, just to make them smaller and not a threat to democracy.

For the whole scale of wealth I also recommend going through wealth shown to scale

All they’d need to liquidate is part of their ownership in said companies. Companies themselves will be ok, don’t you worry your bleeding heart.

That’s not true at all. Loss of controlling ownership makes a company vulnerable to a hostile takeover. The new owners will pick it apart like the vultures they are.

RIP grannies pension plan

That’s the thing people don’t get. The ultra wealthy are wealthy on paper.

On an average years. All of us make more than Elon in wages.

You’re making it sound like the wealthy are rich in technicality only. Maybe the majority of their assets aren’t liquid but they’re still damn wealthy more than “on paper.”

And singling out wages as the only source of income to prove Elon isn’t “actually” wealthy is disingenuous at best.

He’s wealthy but he doesn’t have a high income.

We tax income in America. That’s why Elon pays little and same with bezos. They just don’t have much income.

It personally doesn’t bother me they have billions. They pay their fair share of their taxes just like I pay mine.

You’re not poor because they’re rich. Once you stop focusing on others and focus on yourself; life becomes much easier.

It’s interesting you assume I’m poor just because I’m not licking those boots.

You are. It’s easy to figure out. When people confuse wealth with income, it’s easy to figure out.

People here think there is some finite wealth pie, and if you cut a big piece somehow that leaves more for everyone else

What did Elon get paid, excluding stock options at companies he works for?

I bet he still makes more than me.

Most years under 30k. Often a dollar or free.

https://amp.cnn.com/cnn/2023/02/20/investing/elon-musk-pay/index.html

That actually almost seems worse. He is not paying into Social Security or his local community. He is being generously compensated on stock, which is taxed differently.

Edit: I do want to thank you for providing that link. I was only finding a Forbes article about him being the highest compensated CEO of that year.

He’s paying in the local community through property taxes.

He’s highly compensated through stock and when he bought twitter. We got some huge amount of money in Taxes.

You’re correct. He rarely pays into social but that’s a problem for Congress to solve.

There are many ways to solve this bullshit and one is not allow them to borrow against their stock. That’s how they live for so cheap. I’m not opposed to stopping that at all.

No, they’d just need to liquidate their share in those companies. Those shares would then get bought up by other people or by pension funds.

Or picked apart by private equity vultures at the expense of pension funds.

Well they are public companies bar space x so. Just redistribute those shares.

- Omega_Haxors ( @Omega_Haxors@lemmy.ml ) English42•1 year ago

Sad day when “billionaires should pay taxes” is considered a far left position.

Well, when even the “moderate” right thinks everyone left of the Strasserites is a commie, this is what you get.

Billionaires shouldn’t exist. Their fair share is more like 95%.

And if 95% still leaves them with more than you have you will feel that that rate needs to go higher.

I don’t agree with that. I’m personally completely fine with millionaires or perhaps even 100 millions. Like there should be a social safety net at the bottom there should be a social safety limit at the top even if it is very high and more wealth than anyone could reasonably need. Because beyond that point it’s not they are just getting more wealthy. Everyone else is getting poorer for it.

Well, I’m not so sure about that. If you take that wealth and let the government decide how to spend it, you are assuming it will reach those who need it. I’m not so sure that is the case.

In the current US it would probably go to an even more bloated military budget or other ridiculous projects to line the pockets of people with government connections.

I think the idea is more a long the lines of paying workers more. Instead of shareholders and executives holding 99% of the value of a corporation the workers would take home a much larger portion. Who knows how well that would actually work in practice. Either way I’d prefer multi-billionares forfeit all their wealth exceeding a billion and give it to the government than doing nothing at all. Maybe at least “some” of that could be spent on social programs such as healthcare.

Well I suspect we are looking at this problem through a very simple lens. The billionaires are not necessarily using that money. It is out there being invested and also being loaned out to start new businesses startups etc. if you just handed it to the government assuming it will be better spent or invested is a big leap.

Wealth taxes are stupid. That said, nobody needs multiple hundreds of billions of dollars.

The solution is to have regulations and laws in place that prevent them getting this large in the first place. The fact that Amazon and Google own 90% of the internet is absolutely fucked.

60% of middle class wealth is held in their property. Guess what get’s taxed? Their property. Right now we have a wealth tax on the middle class who are carrying a very disproportionate tax load compared with the rich.

And, even if they don’t own it, Microsoft, Amazon, and Google probably still help run it with Microsoft Azure, AWS, and Google Cloud.

The tax should be even higher. No one needs $100 billion.

Counterpoint: But they don’t wanna pay taxes! They don’t wannaaaaaaaaaaa… why are you being so mean to the precious billionaires?

So there are irreconcilable issues on this issue and Congress is currently too busy trying to impeach Biden because his son had dick pics on his laptop.

I’d be willing to be taxed into oblivion if I knew it’d mean everyone else could lead full lives. And I make nothing.

Now imagine the good their excess wealth could do.

Fuck the billionaires, tax them all by 100% of their income beyond 1 billion.

3% is a fair share?

This is a wealth tax, not an income tax.

too low

Here’s the basic idea of what I’d think is fair

You have a basic rate for income below the 20th percentile of all incomes

Multiply that by 1.5 for income between that and the 40th percentile

Multiply that by 1.25 for income between that and the 60th percentile

Multiply that by 1.125 for income between that and the 80th percentile

Multiply that by 1.0625 for income between that and the 95th percentile

Multiply that by 1.03125 for income between that and the 99th percentile

Multiply that by 1.015625 for all income above the 99th percentile, with the additional caveat that people who top this bracket even once cannot hold public office, donate to political campaigns, or hire lobbyists and lobbying firms for ten years following them topping out.

Imagine something similar for taxes on units of housing owned, dividends earned, and so on and so forth.

The idea being that the highest rate can’t be adjusted without significantly reducing the tax burden of the poorest, basically erasing the only way conservatives have been able to balance the books whenever they try that shit.

Why is it assumed that if the government has more money, then things will be better?

The government is filled with inefficiency that will just be made worse by throwing more money at the issue. Americans are not getting value out of their taxes.

Americans have record low confidence in congress and many officials in government (Supreme Court). Why would we give them more money when they, congress in particular, is responsible for setting the budget?

Why would we give them more? Oh damn, are you a billionaire?

Should billionaires make as much as they do? No

However just taxing them doesn’t get rid of the root issue. It just addresses a symptom.

We should break up the companies that enable billionaires to exist, stimulate competition, raise the minimum wage, put bounds on CEO bonuses, and limit executive pay to a reasonable ratio when compared to the lowest paid worker in the corporation.

The reason for a tax isn’t to give the government money to spend, it already has the ability to spend infinite money for all intents and purposes. The taxation is there to destroy some part of that money to sort of balance the money supply after the fact.

This way of thinking about tax also makes very obvious that taxing income might make the least amount of sense and taxing wealt and transactions, probably is the more reasonable way to go.

The government in the us is obviously innefective but it’s not going to get better by withholding it’s spending money, in fact I’m fairly certain that for almost all government agencies in the US the requirements the law asks of them are largely impossible to hit on their current budget. Sure maybe the regulation could be easier and the oversight requirements less strict, but reducing the budget (except for military and police) wouldn’t help any of the problems that exist when interfacing with these government agencies today, it’d just make them worse

There’s also the fact that Americans have record low confidence in the government as a direct result of the actions of the people who give their billionaire friends tax cuts year after year and make it up by raising taxes for everybody else.

Regardless of how hard it’s to do this, you’ll get what out of this… 15B? That’s nothing… the government spends that in less than a day. Maybe cut government spending in half first. None of this is sustainable.

You hear that everyone? $15 billion is nothing.

You do understand that the government budget is 4 trillion per year, right? Do the math! What’s wrong with you?

It may blow your mind but there are more than 3 wealthy people that live in the USA.

Do the total and calculate it all and show me whether it’s gonna last you a few days.

You plebs can’t do elementary school math and think you should talk policy. What a joke.

well, the top 25 wealthiest americans are together worth about 1.8 trillion, which according to your clock is just about the federal budget deficit and a third of federal spending. The numbers OP gave assume a tax rate of 3% which is already fairly substantial (it would be 3% of the deficit), but we could always raise that number if you feel fit isn’t enough.

I’ll do you one better. Even if you take ALL their money, that’s less than 6 months budget. You steal it from them, spend it in a few months, and you’re back where you started in no time. It doesn’t fix anything or change anything, but introduces tremendous problems (like inflation).

And besides that and completely ignoring all these direct problems, these assets are not even liquid (Surprise surprise, Jeff Bezos doesn’t store $5B in his safe). So, in order to cash them out, you’re gonna have to sell them on the open markets, crash the stock markets, crash real estate markets, etc, which will lead to much higher unemployment, and pension funds will be destroyed (just like in 2008), and millions will go bankrupt. And all this even ignores that the net worth you’re assigning to them ignores slippage, so it’s much less than 1.8 Trillion when sold on the open market, ignoring automated bots that will sell even more to protect their hedge funds.

Yes, let’s do all that destruction in the economy just for 6 months worth of spending. Great plan!

Like I always say: A bunch of ignorant, uneducated, stupid and entitled teenagers who don’t know anything about the economy want to decide how the economy works. Go read a book, and stop telling us how to run the world before you learn how the world works. Go learn, and your realistic suggestions are welcome. We all want a better world.

I’ll do you one better. Even if you take ALL their money, that’s less than 6 months budget.

You’re completely missing the point. There are more than just 3 billionaires in the US. There are more than even 25 billionaires in the US.

You steal it from them, spend it in a few months, and you’re back where you started.

You’re the only one here talking about seizing their entire estate. So sure, your plan is bad, let’s not do it that way.

Like I always say: a bunch of ignorant, uneducated, stupid and entitled teenagers who don’t know anything about the economy want to decide how the economy works.

Dude, you’re talking to two people who are counting billionaires. This weird 'dumb teenager ’ fantasy is all you.

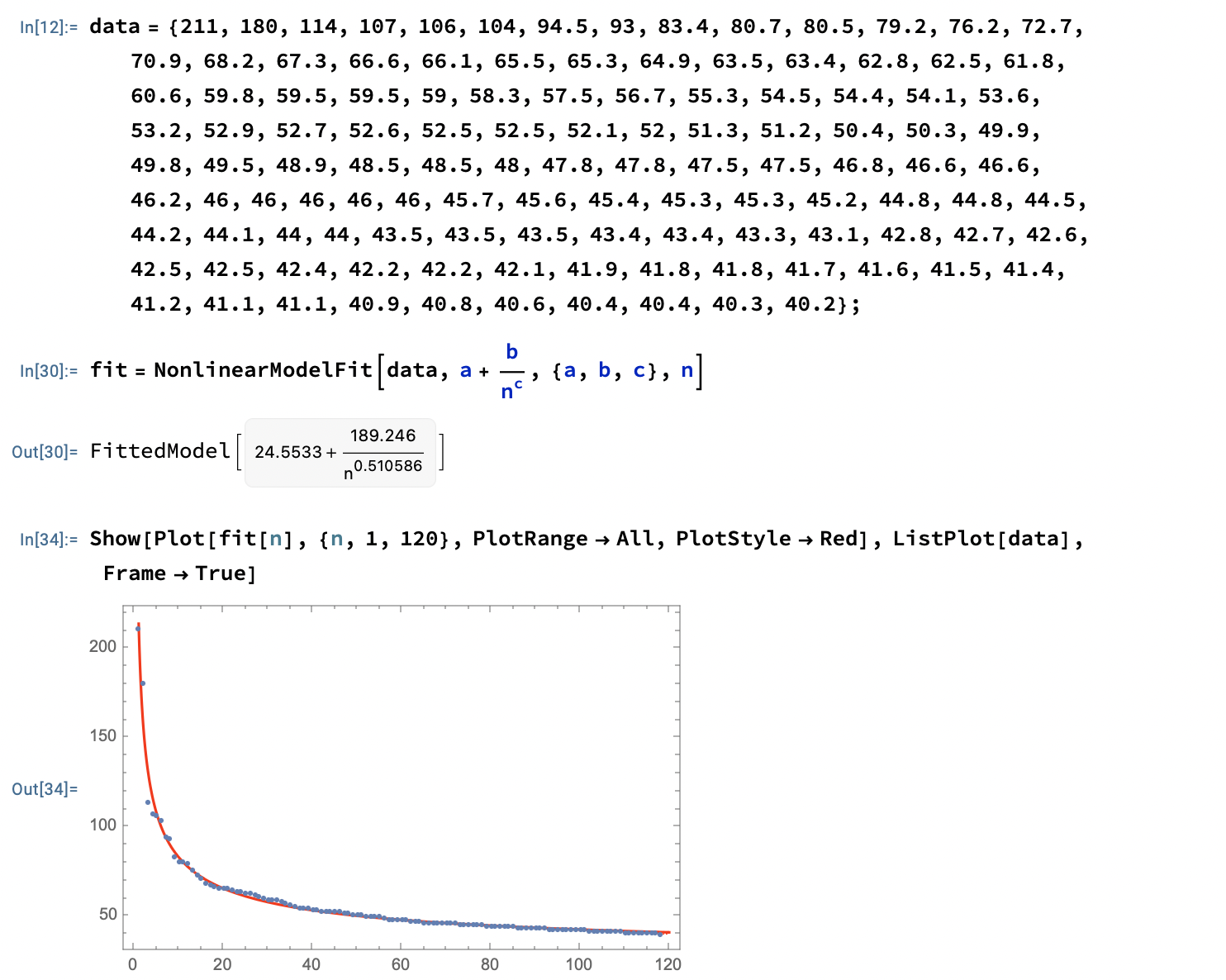

Make a better calculation then come back, and stop criticizing examples. If you understand statistics, you’ll see why whether 25 or 50 billionaires doesn’t make much of a difference. They all mostly follow inverse function distribution in wealth. There’s a law for it, forgot the name. So, no matter what amount you scrape from the top, it won’t make a difference.

Again, ignorance in real world phenomenon and attempts to talk policy. Please stop! Read a book!

come back, and stop criticizing examples

I’ll do that as soon as you define an “inverse function distribution” and give me the name of this “law”.

No matter what amount you scrape from.the top, it won’t make a difference

Patently false. The fact that any taxes work is an obvious counterexample, cause in our progressive tax system they “come from the top”

Please stop! Read a book!

Well you give up quickly. Why don’t you go back and find the name of your law, and then I can give you a reading list.

https://en.wikipedia.org/wiki/Zipf's_law

“Taxes” are not taken from the richest rich as proposed by this dumb OP’s post. That’s why you’re wrong. What a stupid comment you made!

So are you gonna shut up now? Go read a book.

Edit: Because I know you’ll start barking anyway, I decided to fit the data of the top 100 billionaires to an inverse function. Now go read a book and learn how nature works.

Source of the data for 2023 billionaires: https://www.forbes.com/billionaires/

Learn to read, I said they “come from the top,” not the richest. Below a certain income, we don’t tax so what I said is tautologically true.

I’m familiar with Zipf’s law, and what it means in this case is that if you have a distribution of people sorted by wealth, the wealthy are MUCH wealthier than the poor, or worded in the direction of the law the poorest will have money proportional to the reciprocal of the size of the population. You know what that means? It means the wealthy are THE ONLY GROUP that can bear the tax burden.

The more you insist that I should read a book, the more it sounds like you haven’t read any. But keep talking, eventually you’ll understand the implications of what you’re saying.

Wouldn’t a wealth tax be a yearly thing?

But it’s not real money until they want to use it.

I agree we should have a more progressive tax. The problem is fair is a relative term. When is fair fair enough? The fact is the underlying problem is overspending and no amount of “fair” increases to the tax rate is going to solve that problem.

At this point I’d be happy if they would just stop CUTTING the taxes for the rich. Somehow even with massive deficits, that continues to be one of the primary policy positions of the Republican party.

I completely agree. At this point, I really just don’t understand the Republican party. I’m somebody that has always considered myself to be on the side of smaller government and conservative in general but this Republican party does not represent me.